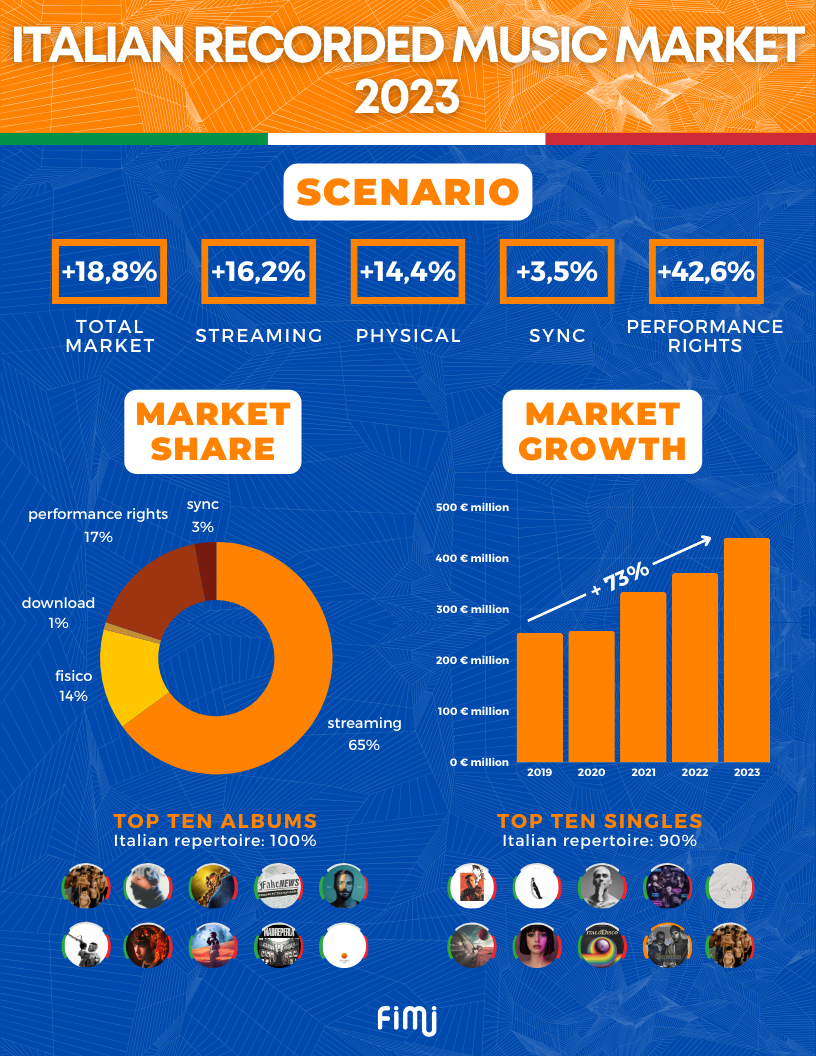

According to FIMI, the organization that represents the Italian recorded music industry, 2023 marks an important milestone for the Italian recorded market, which registers a significant growth of 18.8% for €440 million revenues: this is a sign of an evident vitality of the music market in Italy, which achieves one of the highest growth rates in the world and ranks as the third market in the European Union, achieving the best result ever in terms of percentage with significant increases across all segments. The positive performance of the music market is also recorded at a global level: according to IFPI’s Global Music Report published today, in fact, the increase in the international recorded music market is 10.2%, reaching US$28.6 billion and marking the ninth consecutive year of growth.

In Italy the sector is driven by streaming: it covers an overall market share of 65% and its revenues grew by 16.2%, reaching more than €287 million for a total of over 6.5 million premium subscribers to streaming services (+9% compared to the previous year). In this scenario, revenues from subscriptions to streaming platforms have led the sector: the premium segment has in fact grown by 18.4%, reaching more than €190 million in revenues. In the digital area (which closed with an increase of 15.7%), only the download segment recorded a decrease, down by 11.8%.

The centrality of streaming is also highlighted by the IFPI Engaging with Music report, according to which Italian consumers spent 20.9 hours per week listening to music in 2023 and 60% of the time spent was allocated to listening to digital music (equally divided between audio streaming platforms and long-form and short-form video streaming platforms). Furthermore, 73% listened to music via licensed audio streaming services (subscription or with advertising).

The physical segment records a growth, positioning Italy as the eighth market worldwide: with revenues of almost €62 million, it marks +14.4% and covers a market share of 14% (a figure corresponded to 68% in 2013: in retrospect recounts the long journey of digital over the last 10 years). Vinyl leads the sector, growing by 24.3%, but there is also a resistance from CDs, up by 3.8%.

In this context the impact of the Italian Government Culture Bonus played a central role, which raised €11 million (data non-complete, as it stops at December 2023). Overall, the impact on the recorded music market of the Culture Bonus of the past seven editions is €122 million. The growth of physical revenues reflects the new strategic approach of the sector, which beyond streaming is diversifying its growth factors, keeping superfans at the center: the symbols of this kind of fandom monetization are exclusive releases and recent pop-ups local stores activated on special occasions, from Sanremo week to iconic anniversaries.

The unstoppable dominance of Italian music in 2023 is also evident in the annual Top of The Music charts by FIMI/GfK, which have captured an important affirmation of the local repertoire: 80% of the albums in the Top 100 are Italians, a figure that in 2013 stood at 63%.

The results of the labels' strong investments – also thanks to the Italian Tax Credit – are evident in the number of titles exceeding the fateful threshold of 10 million streaming (premium + free): 793 albums in 2023, + 235 titles compared to 2022. And the comparison with the previous decade shows a surprising growth curve: in 2012 only 137 albums had in fact reached the same threshold with the equivalent of CD sales and downloads (+479% in just ten years).

Performance rights also grew by a significant +42.6% - with a turnover of almost €73 million, which positions Italy as the seventh market globally - and synchronization rights saw an increase of 3.5%, reaching €13 million.

The flourishing scenario of the Italian market opened new frontiers and opportunities in the musical panorama, allowing an important advance abroad: in 2023, in fact, revenues from the export of Italian music grew by 20% (+130% compared to to 2020), for a total royalty income of more than €26 million. Inevitably, even in this segment the digital area is the driver, with revenues growing by 11% to almost €21 million.